Any person or company who knowingly defrauds Medicare or encourages another person or company to submit improper billings to Medicare may be liable to the federal government under the False Claims Act. The False Claims Act allows the government to assess civil penalties of up to $22,000 for each false reimbursement claim submitted to Medicare. For example, if a hospital improperly billed Medicare for treating 20,000 Medicare patients, the False Claims Act would allow the civil penalty to be assessed 20,000 times.

Medicare whistleblowers often want to know how to report Medicare fraud to the government. Our Medicare qui tam attorneys can help you report Medicare fraud in a way that makes you eligible to receive CMS whistleblower rewards of up to 30% of the funds you help Medicare recover.

CMS = Centers for Medicare & Medicaid Services

Medicare Whistleblower Rewards

The False Claims Act not only empowers the government to bring lawsuits to recover funds lost to Medicare fraud, but also empowers Medicare whistleblowers to file lawsuits on the government’s behalf. Under the FCA, a whistleblower with information about Medicare fraud can file what is known as a qui tam lawsuit.

If the qui tam case settles or results in a monetary award, the whistleblower gets a share of the recovery. The whistleblower, who is officially called a qui tam relator, receives between 15 and 30 percent of all money recovered on the government’s behalf. Over the past few years, whistleblowers have earned hundreds of millions of dollars by helping the government recover money that was lost to Medicare fraud.

Medicare Whistleblower Protections

Any employee who files a Medicare qui tam case against their employer under the False Claims Act is entitled to powerful whistleblower protections.

The False Claims Act forbids a company from discharging, demoting, harassing, or in any way discriminating against a qui tam relator due to his or her whistleblowing activity.

A whistleblower who is terminated for filing a qui tam case may be entitled to reinstatement at their job and double back pay (i.e. twice the amount of wages they would have earned while they were out of work).

The Four Parts of Medicare: Whistleblower Guide

The Medicare program is comprised of various parts that may each be subject to Medicare fraud: Medicare Parts A & B, Medicare Part C, and Medicare Part D.

Medicare Parts A & B

Medicare Parts A & B are provisions which relate to what is known as “Original Medicare.” Original Medicare is a health insurance plan that is administered directly by the federal government and is how most people get their Medicare benefits.

Medicare Part A is the ‘Hospital Insurance” provision of the Medicare program. Part A covers ‘medically necessary’ care provided by: hospitals, skilled nursing facilities, home healthcare providers, and hospice workers.

Medicare Part B is the ‘Medical Insurance’ provision of the Medicare program. Part B covers ‘medically necessary’ doctors’ visits, preventative care, outpatient services, lab tests, x-rays, mental and behavioral health care, and durable medical devices. Part B also covers some ambulance services.

Medicare Part C

Part C is the Medicare provision that allows private companies to provide Medicare insurance, as an alternative to the government-administered Original Medicare plan.

Private Medicare insurance plans, such as HMOs and PPOs, are called “Medicare Advantage plans.” Medicare Part C is generally referred to as the “Medicare Advantage program.”

Medicare Part D

Medicare Part D is the portion of Medicare that deals with prescription drug coverage. Prescription drug coverage is provided by private companies that have contracts with the government.

Medicare Part D coverage is not provided directly by the government, regardless of whether the Medicare recipient receives Hospital Insurance and Medical Insurance through Original Medicare or Medicare Advantage.

About Medicare Part D Fraud

The Medicare prescription program, called Medicare Part D, began in 2006 and helps pay for most drugs sold through retail and mail-order pharmacies for roughly 36 million elderly and disabled Americans. Part D is structured differently than traditional Medicare: The federal government pays private companies to administer the benefit, and they in turn pay for the drugs that patients pick up at their pharmacies. According to a report by the Wall Street Journal, out of nearly 3,500 drugs, the top 100 by total cost represented nearly 60% of total Medicare Part D spending. Brand-name drugs for more common conditions like acid reflux (Nexium) and asthma (Advair) represented some of the largest drug expenditures, and drugs that are ripe for Medicare fraud and abuse. Because of the significant sums of government money available and the number of participants in the program, sometimes Part D plan sponsors and/or their Pharmacy Benefit Managers (PBMs) engage in fraudulent practices that result in the improper claims for payment to federal programs, and can therefore form the basis for claims under the False Claims Act.

Pharmacy Fraud and Medicare Part D

The retail value of prescription drugs filled annually in the United States exceeds $300 billion per year. Spending on drugs through Medicare’s Part D prescription-drug program totaled $103.7 billion in 2013, including spending by government, insurers and beneficiaries. The immense size and scope of the prescription drug industry makes it an appealing target for government fraud.

The following are common types of pharmacy fraud litigated under the False Claims Act:

(1) Auto-Refill Fraud

Some pharmacies have been accused of auto-refilling the prescriptions of Medicare patients without their consent and then charging Medicare for the prescription, even though the patient never picked it up. Walgreen’s has been sued for this practice.

(2) Gift Cards and Coupons for Switching Pharmacies

The Anti-Kickback Statute makes it illegal to offer anything of value in order to receive federal healthcare business. A pharmacy may be violating the Anti-Kickback Statute if it offers Medicare patients anything of value (such as gift cards or coupons) in exchange for switching over their prescriptions from a different pharmacy. Any money that a pharmacy receives by offering illegal financial inducements to Medicare patients is subject to False Claims Act liability. Walgreens, CVS, Rite Aid, and Kmart have been sued for this practice.

Pharmaceutical Company Fraud and Medicare Part D

Pharmaceutical companies have been sued under the False Claims Act for defrauding Medicare using the following methods:

- Off-label marketing of drugs for unproven uses

- Kickbacks to doctors for prescribing the company’s drugs

- Overcharging Medicare

- AWP Fraud. Medicare determines the amount it will pay for a drug based on a list of drug prices called the AWP, or “Average Wholesale Price.” The AWP is based on self-reported prices from the drug manufacturers. Some pharmaceutical manufacturers have reported falsely inflated prices to the AWP to get more money from Medicare.

Hospital Fraud and Medicare Parts A & B

The following are common types of hospital fraud litigated under the False Claims Act:

Upcoding

Medicare typically has higher reimbursement rates for hospitals or other providers when a patient receives a more serious diagnosis or undergoes a more expensive procedure. Upcoding occurs when a hospital gives the patient a less serious diagnosis or performs a less expensive procedure, but bills Medicare or Medicaid using the billing code for the more serious diagnosis or more expensive procedure.

Unbundling

Medicare usually reimburses at a lower rate for procedures that are performed in tandem, such as an incision and stitches for someone having their gallbladder removed. In contrast, a procedure that solely performed stitches, such as on a wound that the patient received outside the hospital, would typically be reimbursed at a higher rate. Unbundling, also known as “fragmentation,” is a fraudulent billing practice in which hospitals perform bundled services for a patient but then bill Medicare as if the procedures were performed separately.

Bill Padding

Hospitals and other providers sometimes “pad” the bill for Medicare patients using various techniques. For example, in addition to legitimate lab tests, a hospital may also perform and bill for a slew of non-medically necessary lab tests that were not ordered by the patient’s doctor. HCA was sued for this practice under the False Claims Act.

Other Payment Fraud

In order to ensure that hospitals will continue to accept patients who have very serious and costly conditions, the federal government offers “outlier payments” to hospitals that incur “extraordinarily high costs” while treating Medicare patients. Some hospitals have falsely inflated their cost of care figures in order to obtain more outlier payments from the Medicare program. A report from the Office of the Inspector General found that there may be widespread abuse by hospitals of the outlier payment program.

Failure to Return Overpayments

In 2009, Congress amended the False Claims Act to cover a healthcare provider’s “knowing” or “improper” retention of an overpayment from Medicare. The Centers for Medicare & Medicaid Services (CMS) has clarified that any overpayment made by Medicare to a healthcare provider must be returned within 60 days of when the healthcare provider knows or should have known of the overpayment. Liability under the FCA often arises when an employee of the healthcare provider discovers a number of overpayments, but the healthcare provider doesn’t do anything about it.

Paying Kickbacks to Doctors for Referrals

Hospitals have been sued under the False Claims Act for providing kickbacks to doctors who refer patients to the hospital. The Stark Law prohibits a physician from referring Medicare patients to an entity with which the doctor has a financial relationship (unless an exception to the Stark Law applies). Similarly, the Anti-Kickback Statute prohibits offering or receiving anything of value in exchange for referrals of Medicare patients. Hospitals that violate the Stark Law or the Anti-Kickback Statute are also subject to False Claims Act liability.

Performing Medically Unnecessary Procedures

Some hospitals have been sued under the False Claims Act for performing medically unnecessary surgeries and diagnostic procedures in order to inflate their profits, despite the dangers to a patient’s health that such unnecessary procedures may pose.

Nursing Home Fraud and Medicare Part A

The following are common types of nursing home fraud litigated under the False Claims Act:

Overbilling

- Upcoding. Nursing homes have sometimes violated the False Claims Act by engaging in upcoding. One common example of nursing home upcoding is: when providing rehabilitative services, such as to a patient that has broken her hip, nursing homes have sometimes automatically placed patients in the highest therapy category without doing an individualized assessment of what level of care the patient actually needs. Billing Medicare automatically for the most expensive therapy category is an example of upcoding.

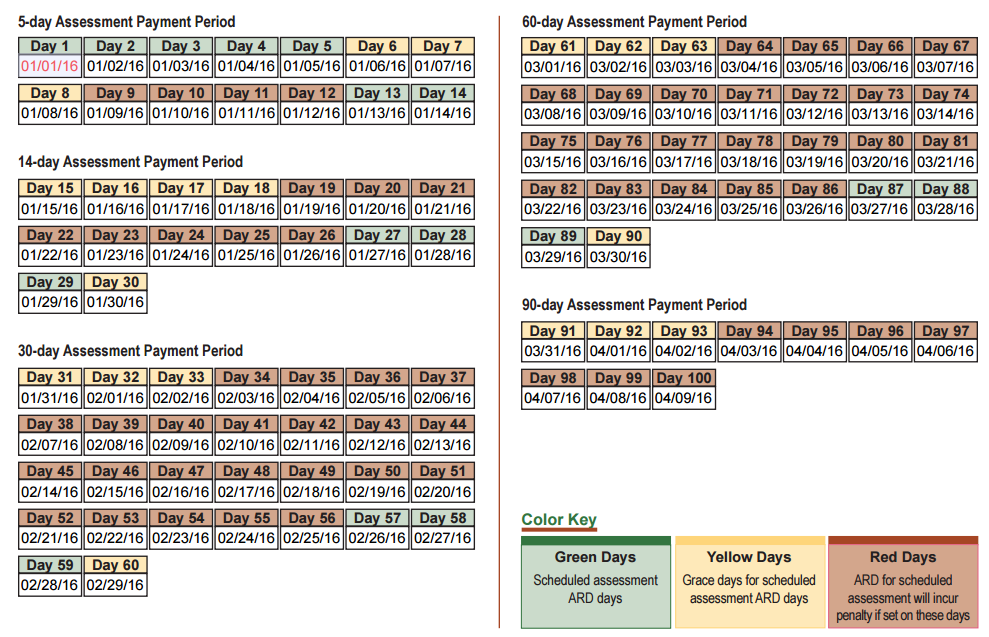

- Ramping. Medicare Part A requires that nursing homes perform regular assessments to determine the level of care a patient requires. Medicare Part A requires that the following assessments be performed:

- a 5-day assessment (performed on days 1-5 of the patient’s stay)

- a 14-day assessment (performed on days 13-14 of the patient’s stay)

- a 30-day assessment (performed on days 27-29 of the patient’s stay)

- a 60-day assessment (performed on days 57-59 of the patient’s stay)

- a 90-day assessment (performed on days 87-89 of the patient’s stay)

For rehabilitative therapy (such as physical therapy, occupational therapy, or speech-language pathology therapy), the number of hours the patient spends doing therapy during the assessment period determines his or her Resource Utilization Group, or RUG level. Medicare reimburses at a higher rate for higher RUG levels. The RUG levels are:

- Ultra High: at least 720 minutes of therapy per week

- Very High: at least 500 minutes of therapy per week

- High: at least 325 minutes of therapy per week

- Medium: at least 150 minutes of therapy per week

- Low: at least 45 minutes of therapy per week

Ramping or roller-coastering is the practice of ramping up the number of hours of therapy given to the patient during the assessment periods, so the patient gets into a higher RUG level, and then decreasing the number of hours spent on therapy during the non-assessment periods, which makes the number of hours of therapy (if graphed) look like a roller coaster. Ramping ensures that a nursing home can bill Medicare at the highest rate possible, while minimizing expenses by offering far less care during the non-assessment periods.

On the following calendar, a hospital that is engaging in ramping will typically do a lot of therapy with the patient during the green days (the assessment period) and do very little therapy with the patient during the yellow or red days.

An analysis by the Wall Street Journal (WSJ) in 2015 found that there might be widespread manipulation of the RUG levels occurring in order to defraud Medicare, because the percentage of patients with an “Ultra High” RUG level jumped from 7 percent in 2002 to 54 percent in 2013.

Substandard Care

Some nursing homes have been found liable to the government under the False Claims Act in recent years for providing substandard care to patients, particularly patients who are bedridden. Substandard catheter care can commonly result in patients getting urinary tract infections, and improper care of bedridden patients can result in bedsores, or “pressure sores”. Nursing home patients who cannot move on their own are supposed to be moved by a staff member approximately every 2 hours to avoid pressure sores.

Facilities that get reimbursements from Medicare agree to meet certain basic standards of care in order to obtain Medicare reimbursements. Providing substandard care to Medicare patients can therefore result in False Claims Act liability.

Hospice Care Provider Fraud and Medicare Part B

Billing Medicare for the hospice care of ineligible patients is considered Medicare fraud under the False Claims Act.

Under the Medicare program, hospice care is provided to patients who are terminally ill, which means they have a life expectancy of six months or less. Once a patient is terminally ill and no treatment is expected to cure the patient or significantly extend her life expectancy, the patient can elect to be cared for by a hospice care worker until the patient dies. Medicare only covers hospice care for the terminally ill. However, some hospice care providers have run afoul of the False Claims Act by trying to bill Medicare for “hospice care” provided to patients who were not terminally ill.

Examples of Medicare Abuse

CMS provides three official examples of Medicare abuse:

- Billing Medicare for services that were not medically necessary

- Charging an excessive amount for medical services or supplies

- Misusing codes on a claim submitted to Medicare, such as upcoding or unbundling codes

Medicare: What does knowingly mean?

CMS is empowered to promulgate rules expanding on or defining liability for Medicare fraud under the False Claims Act.

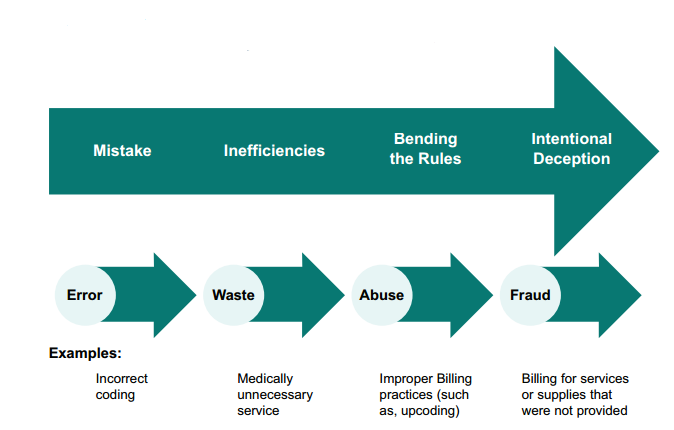

Generally, violations of the False Claims Act must be done “knowingly,” meaning that overbilling Medicare or Medicaid by accident is not a violation of the Act. CMS notes this distinction by stating that “fraud and abuse” of the Medicare and Medicaid programs are violations of the False Claims Act, whereas mere “inefficiencies or mistakes” are not violations.

However, systematic and purposeful billing for “medically unnecessary services” may elevate the practice from a mere “inefficiency” to “fraud.” For example, if a physician performs a medically unnecessary MRI out of an over-abundance of caution, that MRI would be considered an “inefficiency.” But if a hospital systematically performed MRIs on thousands of patients who did not need them, in order to bill Medicare for this service, such conduct would likely rise to the level of “fraud” or abuse.”

Reporting Medicare Fraud

There are two primary ways that you can anonymously report Medicare fraud and abuse to the federal government, as opposed to filing a qui tam lawsuit.

- Call the Medicare Fraud & Abuse Hotline at the Office of the Inspector General: 1‑800‑HHS‑TIPS

- Report the fraud online using the Office of the Inspector General’s Report Fraud Form

However, if you report the fraud directly to the Office of the Inspector General, rather than filing a qui tam whistleblower lawsuit in federal court, you will not be entitled to the rewards for qui tam whistleblowers under the False Claims Act. Medicare whistleblower rewards range from 15 to 30 percent of the total funds recovered as a result of the information the whistleblower provided.

Our Medicare Whistleblower Attorneys

Dylan Hughes

Amy Zeman